As the immigration debate rages on, foreign investors–and their cash–continue to be more than welcome in the USA. Today we’re talking investor visas.

LRI’s Quick Hits

- For business travel, the B-1 Visa is most foreign real estate investors’ best bet.

- Permanent residency is possible but involves investments of hundreds of thousands of dollars.

- Citizens of many countries may not need any visa at all for short-term stays.

Warning Shots

- Stringent requirements, possible system reforms, and lengthy wait times can make traveling here for business difficult.

- Fraud is a rare but legitimate concern for foreigners investing in the U.S., making stateside representation before and during your visit a must.

The internet is a wonderful medium for exploring real estate investment opportunities all over the world, but there’s no substitute for witnessing a luxury property in person. If you’re not a U.S. citizen, when the time comes to conduct market research, meet with your top-notch team of attorney-realtors, or close a deal in the States, you’ll need to have already begun the process of applying for a visa.

There are several ways to travel to the United States as a real estate investor, and which option is best for you depends on your financial means and how long you need or want to stay. Let’s take a look at the avenues available:

B-1 Temporary Business Visitor Visa

If you’re traveling to the U.S. to close on a real estate deal, the non-immigrant B-1 is the visa you’ll need; it’s intended for just those kinds of short-term business activities. This type of visa is technically good for up to one year, but the immigration official who authorizes your entrance to the country will determine how long your visit needs to be to conclude your business. Generally this will be three months or less, although you can file for an extension.

Travel experts say that it takes anywhere from three weeks to a few months to have a temporary visa approved. The slowest part of the process may actually be securing an appointment to be interviewed at your local U.S. consulate. If any family members are accompanying you, they have to obtain their own B-1 visas, which means they have to submit to an interview, as well.

It’s also worth noting that if you’re a male applicant between the ages of 16 and 45 from one of more than two dozen majority-Muslim countries, you may be subject to an additional 20-day waiting period. These countries include Egypt, Iran, Iraq, Pakistan, Saudi Arabia, and Qatar.

Along with your application, you should be able to produce:

- a statement explaining the purpose of the trip, or a letter of invitation from a U.S. citizen;

- proof of necessary funds to cover your trip’s expenses;

- proof of employment and residence and other evidence you plan to return to your home country; and

- travel documentation such as a round-trip plane ticket, hotel and rental car reservations, etc.

Visa Waiver Program

If you’re a citizen of a country that participates in the Visa Waiver Program (VWP), you may be allowed to travel to the U.S. for up to 90 days without a visa. This includes France, Germany, Italy, Sweden, Japan, and 30 other countries (see the complete list here). While here, you will be free to conduct any activities allowed under a B-1 or B-2 tourism visa.

If you’re a citizen of a country that participates in the Visa Waiver Program (VWP), you may be allowed to travel to the U.S. for up to 90 days without a visa. This includes France, Germany, Italy, Sweden, Japan, and 30 other countries (see the complete list here). While here, you will be free to conduct any activities allowed under a B-1 or B-2 tourism visa.

To obtain a visa waiver, you must go through the U.S. Customs and Border Protection’s Electronic System for Travel Application (ESTA). The application takes about 20 minutes to fill out and costs $14.

E-2 Investor Visas

Also known as E-2 Treaty Investor classification, an E-2 non-immigrant visa may be used for a real estate investment deal, under the right circumstances. First of all, to qualify you must be a citizen of one of 60 nations with a Treaty of Trade and Commerce with the U.S. (China and India are two notable countries absent from this list; many of their citizens circumvent this by first obtaining citizenship via investment in Grenada, which does have a treaty with the U.S.)

You also have to be prepared to place a “substantial” amount of your own capital at risk (upwards of $100,000) into a “bona fide enterprise” that you are visiting specifically to oversee. The language as worded would disallow speculative or passive investments in undeveloped land or preexisting homes.

However, if your aim is to purchase land to develop into an apartment complex, for example, you or an employee could very well be able to secure an E-2 visa. Because of the stringent requirements, detailed business plans and any market data you can provide to illustrate your chances of a successful venture may go a long way toward a positive response from the Department of Homeland Security.

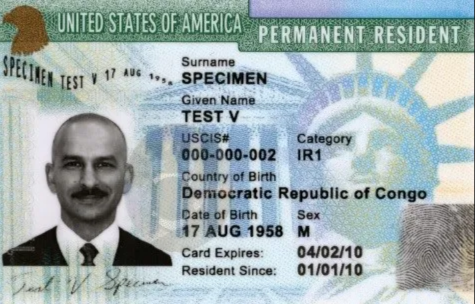

Real Estate, EB-5, and Green Cards

At first blush, the EB-5 Investor Program might not look like a viable means for real estate investors and their families to secure a U.S. Green Card. The program is intended to stimulate job creation and requires investment in a new commercial enterprise that will create 10 full-time jobs that last at least two years. This investment must be at least $500,000 in one of nearly 900 “targeted employment areas” around the country, or $1 million elsewhere.

At first blush, the EB-5 Investor Program might not look like a viable means for real estate investors and their families to secure a U.S. Green Card. The program is intended to stimulate job creation and requires investment in a new commercial enterprise that will create 10 full-time jobs that last at least two years. This investment must be at least $500,000 in one of nearly 900 “targeted employment areas” around the country, or $1 million elsewhere.

However, not only is it a viable option, it’s become one of the most popular avenues to permanent residence available to immigrants to the United States.

While it’s true that simply buying property and building a house on it would almost certainly not qualify for an EB-5 visa, qualifying by investing in a real estate development project has been specifically allowed by the USCIS since January 2009. Developers can save considerable money by accepting EB-5 funds through short-term, low-interest loans, and investors get the traditional benefits of commercial real estate investing: hedge against inflation and the security of tangible assets.

The rate of return is often quite low, around 1%, as investors’ first priority is residency, not ROI. But standard practice is for the developer to pay your legal fees and immigration expenses, and residency is usually granted faster than in other visa programs.

Seasoned legal expertise is highly recommended to represent you and conduct due diligence, as cases of fraud in the EB-5 arena do happen. Moreover, a lawyer can assist you with the copious documentation you’re required to submit with your I-526 application. Finally, a legal team like LRI can help you navigate any changes to the EB-program, as significant reforms appear to be in the offing.

International Luxury Living—Simplified.

No Comments